|

|

|

BLOCKDESK |

|

|

Only you know how bad a money-loss scare you can stand,

or how

small a gain is worth your anxiety

You have to decide these things, to protect yourself from making emotional

mistakes. No one else can, nor should you allow others to attempt to do

it for you.

We can only tell you what some of the best-informed players in the game

think is likely to happen. If it does, then you have the basis– that suits

your needs – for choices among alternatives

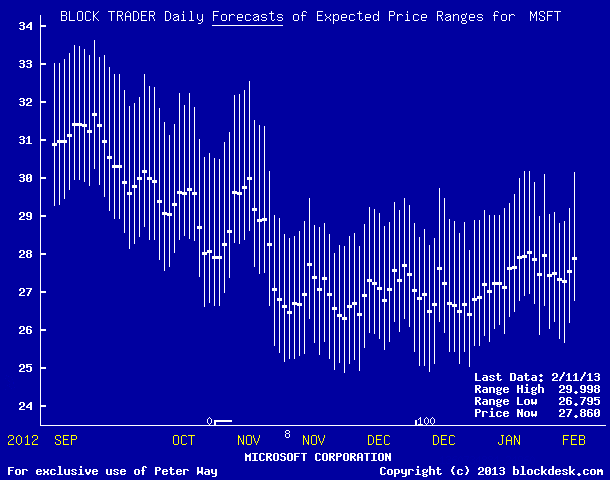

Their daily changes in expectations clearly reflects how the thinking of their market-moving clientele is trending. The way we picture those trends looks like high-low-close actual price charts, but instead of looking backwards at what has happened, these pictures are of how the forward look into the future is changing.

|

Click on the thumbnail to the right to see a full-size example of Block Trader Forecast trends, along with the kind of scorecard we update daily on each issue. While the forecasts are credible -- they daily bet their jobs and the firm's capital -- on their ideas, they are human too, working where things change, often rapidly, so some mistakes are inevitable.

| |

| The perspective of upside-to-downside price change prospects of the BTF chart serves well the comparisons of one stock or ETF across time. But not the comparisons of many stocks at one point in time, which is what the Volatility Map does. On an X-Y plot basis, forecasts (all of the current day) show the lowest-risk downside forecasts nearer the bottom, and those with the largest upside toward the right. |

|

| A useful starting point for investment decision comparisons are the price range forecasts implied from the self-protective behaviors of the market-makers and their actual stress experiences. These are shown for groups of stocks, or ETFs, like the subject of your interest. The Reward~Risk Tradeoff plots illustrated by the thumbnail to the right will lead you to an enlarged explanation of their use, in conjunction with the Block Trader Forecast trend pictures and other comparative tools. |

|

| The Market-Makers do their best to avoid risk, which reflects their views of how likely the price will rise or fall for a given Index, Fund, or Equity. Their track record of prior predictions is reflected in the Odds vs. Payoff report, and offers insight into how likely today's prospects are to make similar gains. Learn how to capitalize on their wisdom and experience... |

|

| Wouldn't it be convenient to see the WHOLE population's state of health at a glance, rather than just rely on what the major indexes are showing? The Market Profile provides this at a glance. |

|

Objective, Unbiased, Productive

| |